If I Were BROKE… This Is What I’d Do

Here's a summary of the video "If I Were BROKE… This Is What I’d Do":

Importance of Paying Yourself First: Emphasizes that before any other expenses, you should set aside a portion of your income (like 10%) into savings to secure your financial future.

Assessing Expenses vs. Income: This advice analyzes your financial situation by understanding your expenses and ensuring they are less than your income to achieve financial freedom.

Cutting Unnecessary Expenses: Avoiding luxuries and non-essential spending to reduce expenses and increase savings potential.

Investing in Self: Stresses the value of investing in personal development and skills to increase income potential, such as taking on extra work or learning through free resources like YouTube.

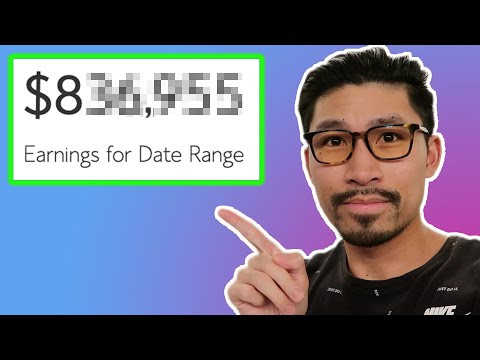

Starting a Side Hustle: Proposes starting a low-cost side business like Kindle publishing or affiliate marketing to generate additional income, leveraging initial savings.

These steps outline a strategic approach to rebuilding financial stability and fostering long-term wealth.

Here’s a summary of the video “If I Were BROKE… This Is What I’d Do”:

Importance of Paying Yourself First: Emphasizes that before any other expenses, you should set aside a portion of your income (like 10%) into savings to secure your financial future.

Assessing Expenses vs. Income: This advice analyzes your financial situation by understanding your expenses and ensuring they are less than your income to achieve financial freedom.

Cutting Unnecessary Expenses: Avoiding luxuries and non-essential spending to reduce expenses and increase savings potential.

Investing in Self: Stresses the value of investing in personal development and skills to increase income potential, such as taking on extra work or learning through free resources like YouTube.

Starting a Side Hustle: Proposes starting a low-cost side business like Kindle publishing or affiliate marketing to generate additional income, leveraging initial savings.

These steps outline a strategic approach to rebuilding financial stability and fostering long-term wealth.

Thanks! Share it with your friends!

Tweet

Share

Pin It

LinkedIn

Google+

Reddit

Tumblr